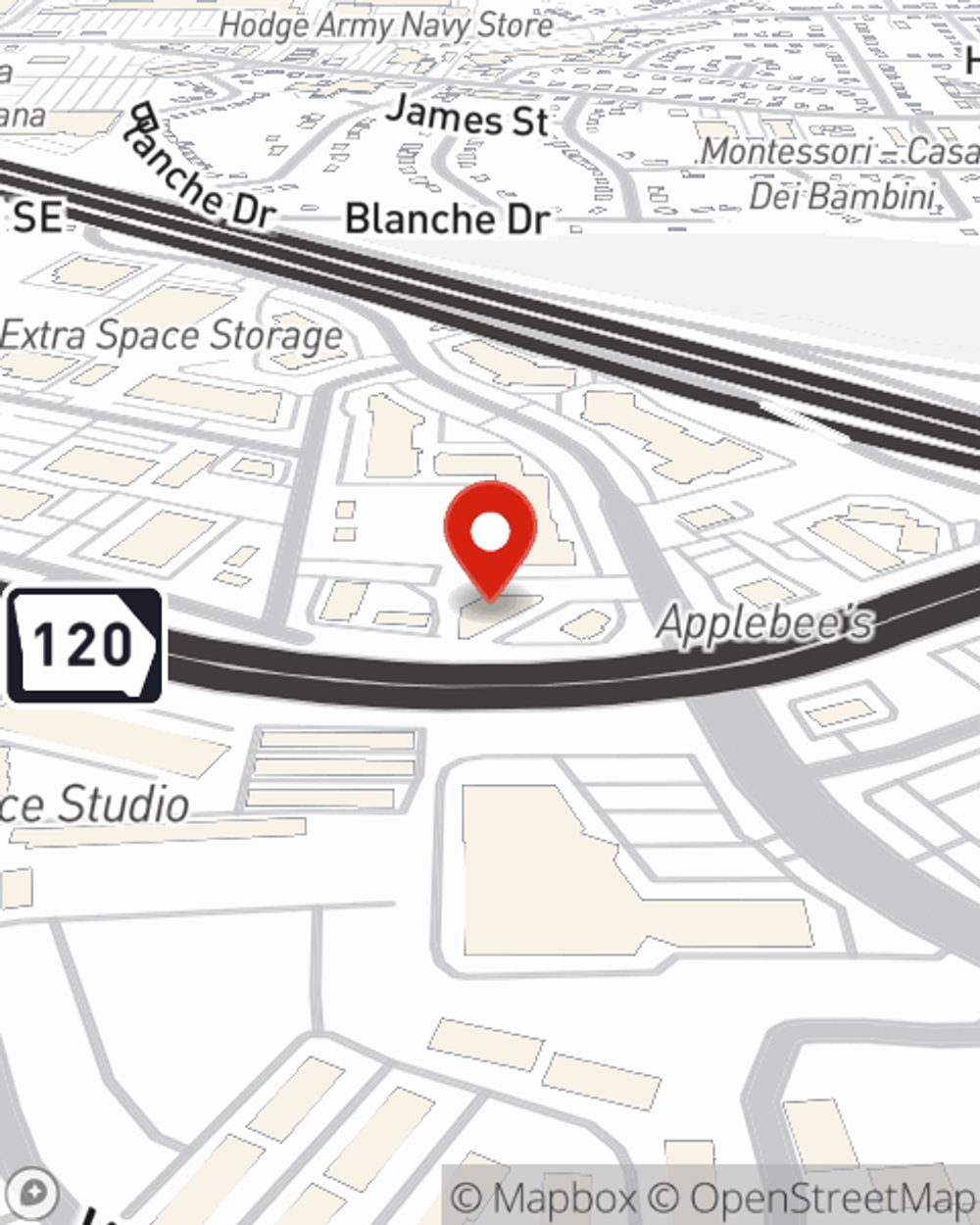

Business Insurance in and around Marietta

Calling all small business owners of Marietta!

Almost 100 years of helping small businesses

- Marietta

- Smyrna

- Roswell

- Woodstock

- Acworth

- Powder Springs

- Kennesaw

- Alpharetta

- Holly Springs

- Canton

- Austell

- Cartersville

- Dallas

- Cumming

- Duluth

- Lithonia

- Buford

- Lawrenceville

- Tennessee

- Florida

Help Prepare Your Business For The Unexpected.

Running a small business is no joke. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, contractors, trades and more!

Calling all small business owners of Marietta!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Brandon Wine. With an agent like Brandon Wine, your coverage can include great options, such as commercial auto, commercial liability umbrella policies and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Brandon Wine's team to explore the options specifically available to you!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Brandon Wine

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.